In Brief

- Digital transformation isn’t just an IT upgrade—it’s a reimagination of work, decision-making, and collaboration.

- The opportunity for enterprise functions: evolve from service providers to strategic business partners.

- Real transformation happens when vision, people, processes, and technology turn strategy into action and fuel growth.

Done right, companies can use digital transformation to reposition corporate functions as key drivers of growth, translating bold aspirations into tangible results and moving strategy from design to doing. By leveraging advances in automation and AI, organizations increase efficiency in functions like finance, sales, HR, and marketing while also unlocking new ways of thinking, solving problems, and adapting to change.

However, too often, companies default to a technology-centered approach without addressing the transformation strategy needed to align functions with broader goals. This misstep leaves many entrenched structures and ways of working unchallenged—what Innosight’s cofounder Clayton Christensen called the trap of “architectural inertia” in his theory of disruptive innovation—limiting their ability to adapt.

Companies can tackle this inertia by recognizing that, while technology can be complex, the real challenge lies in driving organizational change. This requires breaking down silos, fostering new behaviors, and upskilling and reskilling talent—rather than protecting longstanding capabilities, routines, and organizational boundaries. Only then can they unlock the massive potential of their growing data-centric operating architectures.

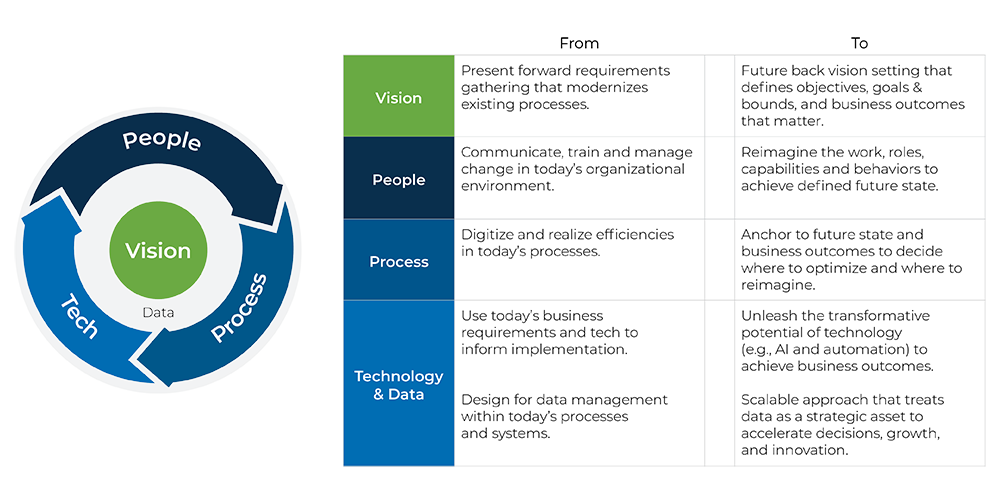

Figure 1: A Holistic Approach to Building Future-Ready Functions

The figure illustrates how future-ready functions reshape the four foundational building blocks— vision, people, process, and technology—to better align corporate functions with business strategy.

By taking a structured transformation approach that firmly connects corporate strategy with functional execution, companies can develop a framework to ensure their digital transformation is tightly anchored to delivering their future business strategy. This means aligning leadership priorities with how people work, how processes operate, and how technology supports both. Four key elements make this possible:

- Vision links long-term goals with immediate actions to enhance performance and build a scalable foundation for growth.

- People represent the roles, capabilities, and behaviors to drive alignment and execution.

- Process determines where to eliminate, optimize, or reimagine workflows for better outcomes.

- Technology and data provide the architecture to integrate automation, AI, and data-driven decision-making.

In this article, we share what it takes to drive true transformation by focusing on these four elements, based on our work with clients in building next-generation operating models and reshaping corporate functions.

Align Functions with Your Organization’s Vision

Too often, corporate functions operate in isolation, focused on their own short-term priorities rather than advancing a company’s strategic goals. Aligning them with an organization’s purpose and long-term aspirations positions leaders to drive change. The challenge isn’t defining a vision—it’s turning it into capabilities that fuel growth, innovation, and operational excellence. This shift turns teams into true business partners, bridging the gap between strategy and execution.

We partnered with a fast-growing technology company with an ambitious goal: expanding its subscriber base by 10-times in core geographies it serves. Achieving this required more than a product strategy—it called for an operating model designed to scale rapidly and efficiently. Its finance function needed to eliminate manual processes, streamline technology, and build capabilities to deliver more meaningful insights.

We defined a vision for the finance function to create a foundation for sustainable growth. The leadership team applied a future-back approach, starting with a clear view of the function’s long-term role in enabling business growth. From there, leaders determined the key capabilities, technology investments, and process changes required to make it a reality.

With this vision in place, the next step was aligning the finance operating model to support it. That meant focusing on key objectives, each tied to actionable enablers, including:

- Deliver real-time, accurate data for better decision-making by creating a scalable, data-driven finance platform.

- Foster seamless collaboration across departments by empowering teams with shared accountability and new ways of working.

- Build a leadership pipeline to support future growth by equipping leaders with the skills and mindsets to embrace change.

- Leverage predictive analytics to anticipate market trends by embedding advanced tools and insights into daily operations.

Establishing a clear vision for the finance function enabled the leadership team to evolve and support growth. The team improved processes, adopted new technology, and strengthened workflows, skills, and behaviors needed to prepare for the future. This positioned the company to deliver on its vision of serving more consumers with a seamless experience while scaling profitably.

Build Adaptive Capacity to Drive Lasting Change

Corporate functions struggle to adapt when rigid structures and ingrained behaviors slow decision-making. Adaptive capacity—an organization’s ability to learn, adjust, and respond to disruption—helps teams evolve with change instead of resisting it. Companies build this by reinforcing leadership behaviors, shifting mindsets, and embedding organizational agility into how functions operate.

At a leading global beverage company we partnered with, the finance function was siloed, with employees deeply tied to long-established ways of working. The culture rewarded “busy-ness” over results, and competing priorities made it difficult to drive change. To build adaptive capacity, leadership focused on shifting behaviors and mindsets, emphasizing agility, empowerment, and curiosity while addressing blockers that slowed decision-making and reinforced rigid work habits.

To sustain these shifts, the company defined specific leadership behaviors to help teams navigate tensions between empowerment and agility. Leaders were equipped to ruthlessly prioritize and reward behaviors and results equally, creating consistency that fostered trust and safety among employees. By holding leaders accountable, the company ensured adaptive capacity was embedded in how teams operated.

As the CFO put it, “To be the kind of leader we need, they are going to have to stretch and adapt—we all need to challenge each other to step up. How we show up matters, and it’s not 80% of the time, it’s 100% of the time.”

At the fast-growing technology company we helped, building adaptive capacity started with assessing team readiness for change. Some employees expressed fears like, ‘Is my job going away?’ or ‘Can I learn new skills?’ Leadership took deliberate steps to address these concerns:

- Training and Upskilling. Targeted interventions and tailored workshops helped employees build skills needed for new ways of working.

- Psychological Safety. Leadership reinforced a culture of openness, encouraging teams to experiment, take ownership, and embrace change.

- Ongoing Communication. Leadership maintained continuous dialogue to break down resistance, align teams with company objectives, and accelerate adoption.

These efforts strengthened team confidence and reinforced the organization’s commitment to adaptability. By embedding adaptive capacity into leadership and culture, the company advanced its broader growth agenda and positioned finance as a stronger strategic partner.

Another common consideration for many finance functions is the growing need to adapt to being a digital workforce while also shifting from being scorekeepers who primarily track and report financial info to being strategists who embrace value-driven analytics that inform business decisions. These are examples of where building adaptive capacity is critical to achieve targeted transformative outcomes.

The experience at both companies we worked with was the same—building adaptive capacity wasn’t simply a change management initiative. As one CFO told his team, “This isn’t a project, this is about building the capability to continuously transform.” It was an investment that reshaped leadership and culture, ensuring finance functions could drive growth and remain resilient.

Invest in a High-Quality Data Foundation

Data is the backbone of a company’s ability to adapt and thrive, yet many organizations struggle to manage it effectively. Siloed systems, inconsistent definitions, and misaligned priorities prevent companies from treating data like a strategic asset. Without a strong data foundation, AI-powered decision-making slows, initiatives fall short, and transformation efforts stall. Companies that apply the same discipline to data as they do to strategy, culture, and talent development unlock its full potential, creating a competitive advantage.

A global software company operating in more than 150 countries illustrates the impact of a well-structured data foundation. The company faced data inconsistencies, slow reporting processes, and fragmented systems that hindered operations. Finance teams spent hours manually reconciling reports, customer data was unreliable, and business decisions were delayed due to a lack of real-time insights.

To address these issues, the company focused on four key elements of a strong data foundation:

- Well-Defined, Timely Data – Ensuring accurate, consistent, and accessible data enables teams make to informed decisions when they matter most, preventing delays caused by conflicting or incomplete information.

- Integrated Structures and Storage – Seamless infrastructure enables data to flow across functions, breaking down silos and equipping teams with the tools they need to collaborate effectively.

- A Product Mindset – Treating data as a strategic product, not just an IT asset, ensures alignment between the data management framework and business priorities. This fosters ownership, accountability, and strong governance processes, protecting the competitive advantage and efficiencies embedded in high-quality data.

- Change Management Focus – Building trust in data quality and fostering data literacy across teams strengthens overall adoption and ensures long-term data integrity.

By rethinking how data was structured, delivered, and managed, the company transformed it into an internal product that provided immediate, tangible value:

- Order processing and fulfillment that once took days now happens in seconds.

- AI-powered territory alignment eliminated spreadsheets and hours of meetings.

- Cross-business unit reporting, previously reliant on merging data from disconnected systems, now occurs in real time.

A high-quality data foundation is not just a technical fix—it’s an organizational capability. As one client noted, “Like the effort and care our R&D team invests to bring a consumer product to market, so should be the effort given to define how data is used as a business asset.” Companies that embed data into their culture, mindset, and operating model enhance decision-making, adaptability, and innovation.

Strategically Embed Technology in Functions

Many companies invest in digital tools but fail to see real impact because they automate outdated processes instead of rethinking how work gets done. True transformation requires more than digitizing existing workflows—it requires redesigning processes to apply best practices for digital transformation and align with new capabilities and business priorities.

To accomplish this, organizations should identify the small set of business requirements that make a function strategically unique and ensure those needs are embedded into its processes and technology. Everything else should be standardized and automated to create a scalable and efficient foundation for growth. This is known as “design by exception,” an approach that focuses customization only on the areas that drive differentiation while leveraging standard solutions for everything else.

For instance, with modern cloud platforms, corporate functions can either use built-in capabilities for standard needs—such as payroll processing in HR or financial reporting in finance—or customize select areas that are critical to their strategic role. Customization should be reserved for what truly creates competitive advantage, such as proprietary pricing models in finance, specialized analytics in marketing, or differentiated workflows in operations.

At the fast-growing tech company that we worked with, the CFO recognized that simply layering technology onto existing finance processes wouldn’t drive meaningful change. He challenged his team to take a first-principles approach to automation, focusing on efficiency and business impact. His team embraced four guiding principles:

- Challenge the status quo. Always ask: What can we change or innovate?

- Cut redundancies. Eliminate unnecessary processes or steps.

- Refine what remains. Simplify and optimize what can’t be eliminated.

- Automate with intention. Introduce automation only after these steps are complete.

This approach transforms technology from a tool to an enabler of strategic transformation, ensuring every technology investment delivers meaningful improvements and directly supports business objectives. By streamlining workflows, and integrating automation strategically, companies eliminate redundancies and ensure technology supports business priorities rather than reinforcing outdated processes.

Achieving this broader transformation requires a fundamental shift in how corporate functions operate. Redesigning workflows with purpose and deploying technology strategically enables companies to ensure their functions become adaptive, strategic drivers of long-term growth.

True transformation isn’t just about technology or simply optimizing or modernizing today’s processes—it’s about reimagining how works gets done and creating the conditions where teams can adapt, innovate, and thrive. By aligning vision with execution, fostering adaptive capacity, and building a foundation of data and technology, companies can turn finance, sales, HR and other critical functions into engines of growth.