In Brief

Financial solutions for federal directives disruption

- Federal directives are causing liquidity challenges in higher education, impacting research funds, tuition revenue, and endowments, requiring institutions to adapt quickly to evolving uncertainties.

- Reviewing restricted and quasi-endowment fund balances can uncover underutilized resources, offering significant opportunities to address immediate financial needs and support strategic priorities.

- Newfound liquidity can help institutions improve financial resilience, make better-informed decisions, improve donor stewardship, and enhance visibility into financial health.

Many institutions within higher education and academic medicine are forming contingency plans to mitigate liquidity constraints that may arise from recent federal directives. These directives, some of which are currently being contested in court, have led to delays in the disbursement of research funds from federal agencies, a potential decline in tuition revenue due to reduced international student enrollment, and a possible increase in the endowment tax. These situations are evolving with many unknowns, making it challenging to predict the full impact and requiring institutions to remain adaptable and vigilant as new information emerges.

Institutions may be facing additional financial challenges for a variety of reasons and may be in search of flexible funding sources to meet these challenges. While these financial pressures create a sense of uncertainty, institutions can take action to lessen near-term impacts and position themselves for long-term stability.

What you can do today

Institutions often underutilize restricted and internally committed balances. Traditional budgeting practices may not account for the dynamic needs of an academic institution, resulting in some funds remaining untapped. As a result, significant amounts of money may sit idle instead of being used to address pressing financial challenges or invested in growth opportunities. To alleviate immediate financial pressures, institutions should first assess the use of fund balances with an all-funds perspective.

The first step? Consider reviewing the balances in restricted, internally committed, and institutionally funded endowments — also known as quasi-endowments — to determine whether funds are still appropriate and are being deployed as intended. Examples of stagnant funds include professorships or other initiatives for which the intended role was never filled or for which a program was not fully implemented. A detailed review of gift documentation, including current uses and historical balances, can often uncover underutilized funding sources that have accumulated extensive balances. These balances often represent a significant opportunity to replace funding for programs provided through unrestricted institutional support. By examining these funds, institutions may find opportunities to reallocate resources more effectively to address current liquidity needs.

| Real-world impact |

|---|

|

Releasing discretionary funds offer many benefits, including much-needed flexibility to support strategic priorities and respond to evolving needs.

|

How to relieve financial pressure

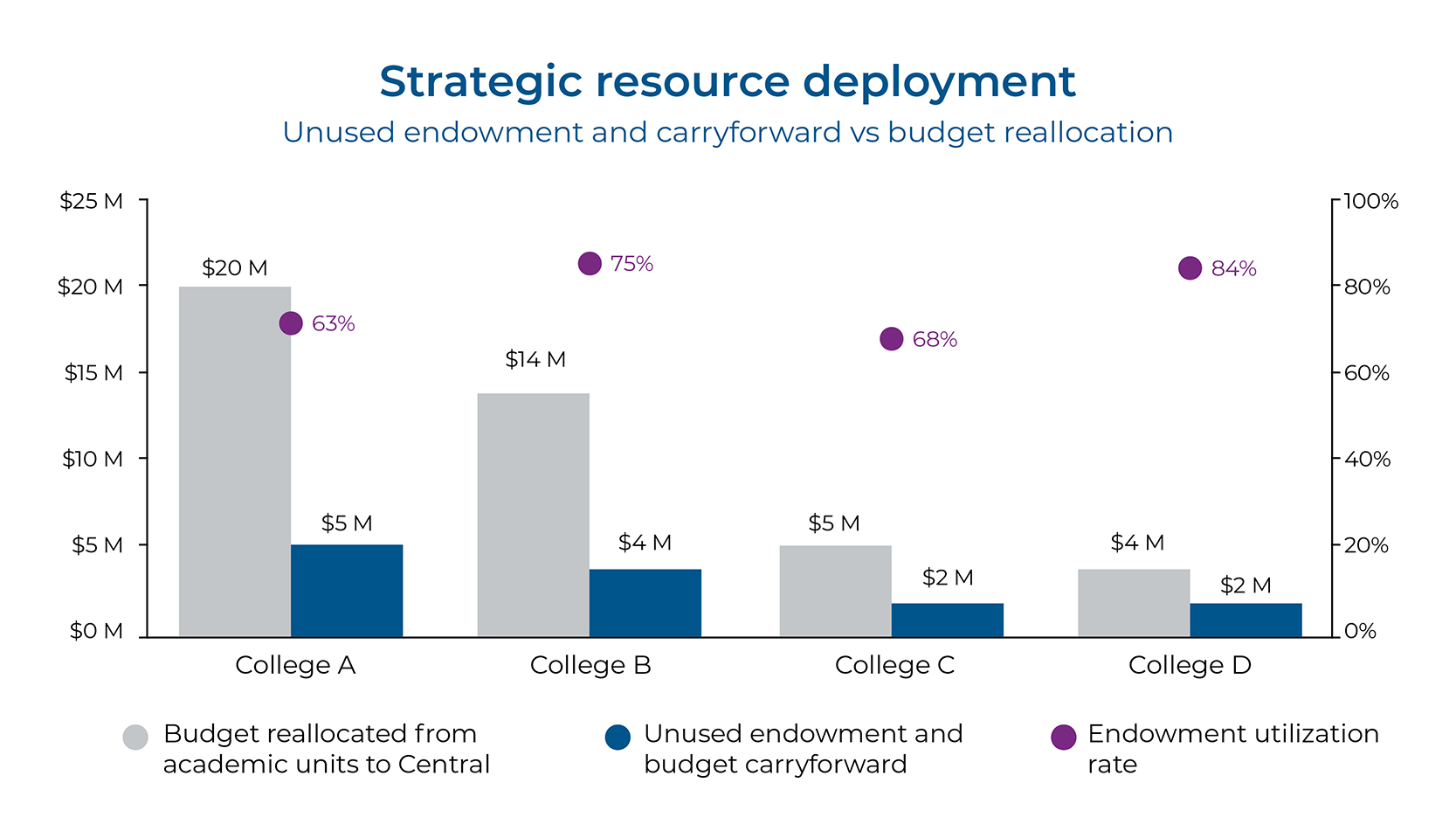

Over the past few years, Huron has collaborated with various colleges, universities, research, and academic medicine institutions to support student aid, research, and other priorities by identifying and redeploying balances ranging from $4M to over $100M.

Given the demands of day-to-day operations and the complexities of evolving federal directives, it is understandable that many institutions may find it difficult to allocate the necessary resources and time to address financial pressures promptly on their own.

Institutions have multiple options for validating or developing a financial planning model that accounts for potential federal directives, while also uncovering significant liquidity opportunities through analysis and categorization of fund balances, aligning them with expenses that may have been funded with general institutional resources.

In doing so, it is critical to prioritize the use of the most restricted dollar first, aligning with the first-dollar rule and leaving flexible funding available for key priorities. By reallocating underutilized funds, institutions can support immediate needs and long-term goals.

Layering AI to this approach simplifies the initial review process by organizing and documenting information consistently. This helps clarify actual liquidity and ensure that funds align with donors' intended use, freeing up teams from manual work to focus on strategically utilizing identified opportunities and setting the stage for better fund management practices.

The result? Institutions that are financially resilient make better-informed decisions, improve donor stewardship, and enhance visibility into financial health.